Clinical trials are costly necessities for research and development (R&D) of novel devices and treatments, yet with more than half failing to finish, they become even costlier for pharmaceutical companies. Without R&D, we would not have products like birth control or cancer interventions. To protect organizations financially that build the cures of the future, we have what is called a “patent.” Patents ensure exclusive rights to a product, preventing anyone else from making or selling the product during their active period. This crucial period helps organizations to recoup costs incurred during the R&D phase. When a patent runs out, competitors jump in, manufacture the product, and lower the price. Up to 80% of pharma’s revenue comes from patents, so streamlining and minimizing the time it takes to conduct a clinical trial should be a priority.

Patents are not a recent development. In fact, they date back to the 14th century when King Edward ll wanted to entice European skilled workers to come to England and start new innovative industries. King Edward gave the expatriates letters providing them with a monopoly on their trade called “letters patent,” paving the way for what we know today as a “patent.” In current times and relating to medical intervention, patents are not a lifetime monopoly and typically last between 15-20 years from the date of patent application filing.

For pharmaceutical companies, delays in the result are significant. A patent’s life begins as soon as the drug is discovered and registered, a single day’s delay can cost pharma up to $10 million USD.

Mylan V Sun Pharma and Current Regulatory Issues

Firstly, a drug or any medical-related device with its respective manufacturers must patent a new “invention” before it even gets to the first clinical trial stage. This is because they do not want their invention to be copied before it is protected. Publicly available clinical trial information can pose a significant risk to a patent or patent application, as recently in the Mylan v Sun Pharma case1. Despite patents on their products, Mylan had released information on the treatment before receiving the patent – making their patent claim as a novel treatment void and null. This was a costly learning exercise for Mylan and a warning for all pharmaceutical and medical device companies – “Patent your products now, not later.”

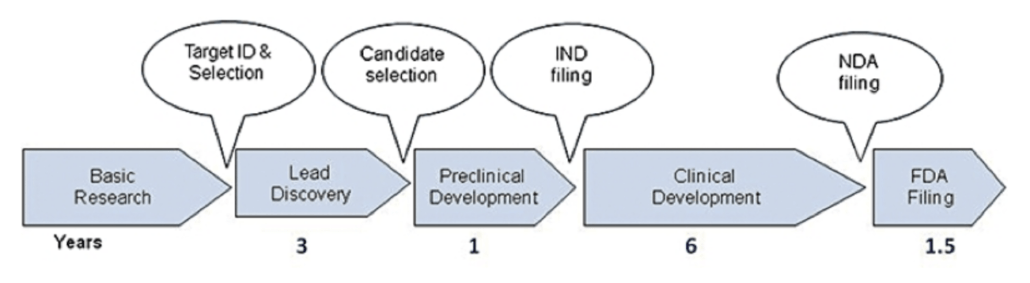

Secondly, while legislators have implemented several patent changes to compensate for time lost during clinical trials2 overall cost and investment returns remained subpar for many pharmaceutical companies. Here is an easy investment breakdown based on extensive research and reviews:

Creation: 7-12 drugs targeted

Time: Minimum 8–15-year period, including phases of clinical trials

Cost Invested: 1-5 Billion USD

Awaiting Approval: Typically, 5+ years from a local government body (For example, FDA, EMA)

Remember the 15–20-year period and a single day’s worth of delay mentioned above? If we analyze the approximation values above, we can instantly deduce there is insufficient time to recover the cost invested based on the current patent regulations. Arguably, of course, why not just apply for patent extensions? Unfortunately, it is not such a straightforward solution. Patents towards medical devices and chemical creations are commonly given extensions of up to 5-7 years. Orphan drugs3 can be granted up to 7-10 years. While the time period may extend, we have not factored in the likelihood of delays of clinical trials in the different phases, global supplies, and commercial and operational issues. Even with researchers adopting a “patient-centric” approach, the underlying factors based on existing data still highlight pharmaceutical companies losing 80% of their revenue when a patent finishes.

Figure 1. Self-illustration of Time Phases and Operations in Clinical Trials (Simplified Version).

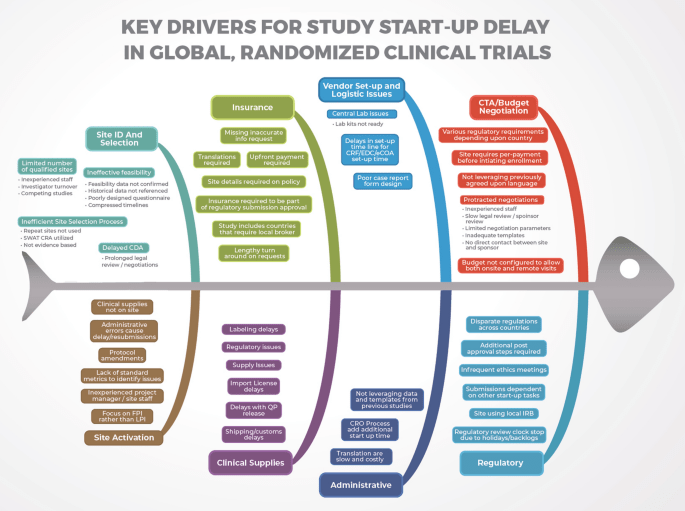

Figure 2. Key Drivers of Delays in Clinical Trials. Source: The Lancet – Biosciences and Law.

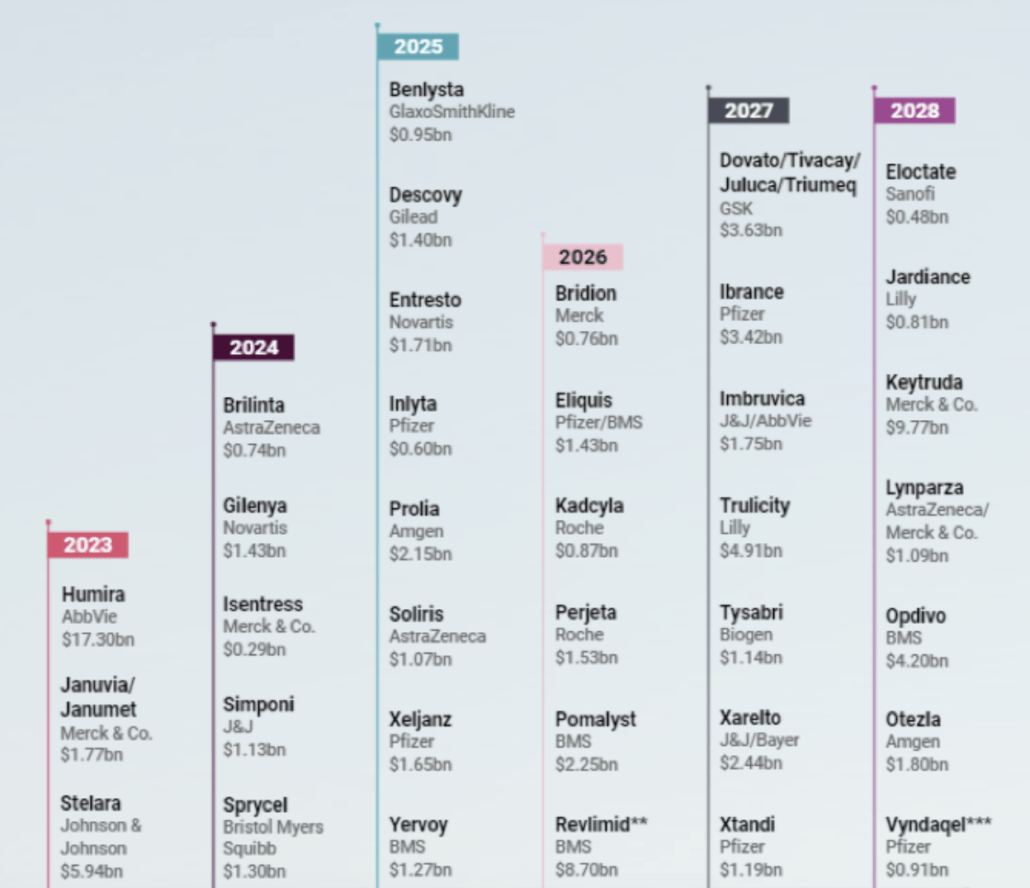

The Coming Patent Cliff.

According to experts, the pharmaceutical industry is amid a steady period of moderate growth, but financial woes are creeping in, and the mid-decade outlook is looking grim. Investors are particularly wary between 2025-2030, when many big brands lose market exclusivity in the US and Europe, facing generic or biosimilar competition for the first time. As such, pharma companies appear to be looking a little grim without the pipeline to make up the deficit. This may put more pressure on drug makers to rely on business development as the tool to fill it. Even so, the question remains whether this is a sustainable option.

Figure 3. Timelines are estimates based on crucial patent expirations or patent settlement agreements and the life of a brand that can be shortened or lengthened due to various factors. Source: Scrip and Biomedtracker

** Under patent litigation settlement

*** Pending patent-term extension

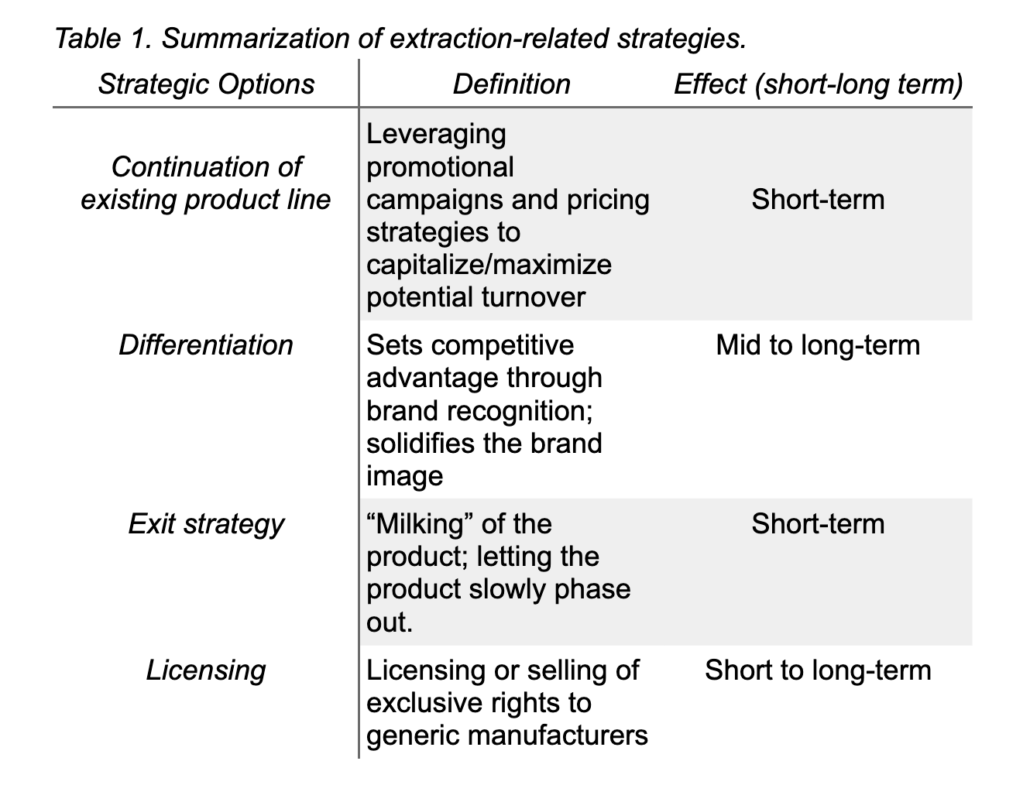

With ‘blockbuster’ drugs like Stelara, Eliquis, Prolia, and Soliris poised to lose US exclusivity over the next five years, the patent cliff might provide a unique opportunity for participants in the current healthcare system to collaborate and reinvent the current model of drug discovery and marketing for sustainable development. For example, identifying an “extraction strategy” to fully exploit the current market position without making additional investments in a particular production innovation4. Two approaches can be taken under this strategy.

First is the continuation of the existing product line without further modifications of the product offering. This strategy aims to secure the product turnover for as long as possible by measures related to a marketing campaign or pricing strategies and cutting the product-related expenses before or with the patent’s expiration.

The second is selling or licensing a patent to generic suppliers before the patent expires. Instead of a controlled, strategic withdrawal from the product line, selling or out-licensing compounds (For example, existing patent rights and trademark attributes) to other entities may be more appropriate. Licensing might benefit the patent holder through externalities from standards creation or access to the licensee’s complementary technologies.

Cost Effectiveness – Clinials, Artificial Intelligence (AI) and technology

While these solutions may help in the short run, for drugs or devices already created, they are not a competent solution for future R&D. So, how can we increase the time period of products on the shelves for pharmaceutical and device companies? By reducing the substantial time spent orchestrating a clinical trial’s recruitment process. Recruitment time can vary, but often for trials with difficult-to-understand protocols and a lack of patient-friendly information, it can last several years, even decades. By streamlining and simplifying the protocol into manageable information for participants, recruitment time can be minimized, resulting in increased profits for pharma and enlarging R&D budgets. Only the Clinials platform allows researchers to use AI to convert complex protocols into patient-friendly language while also giving sponsors insight into the recruitment process.

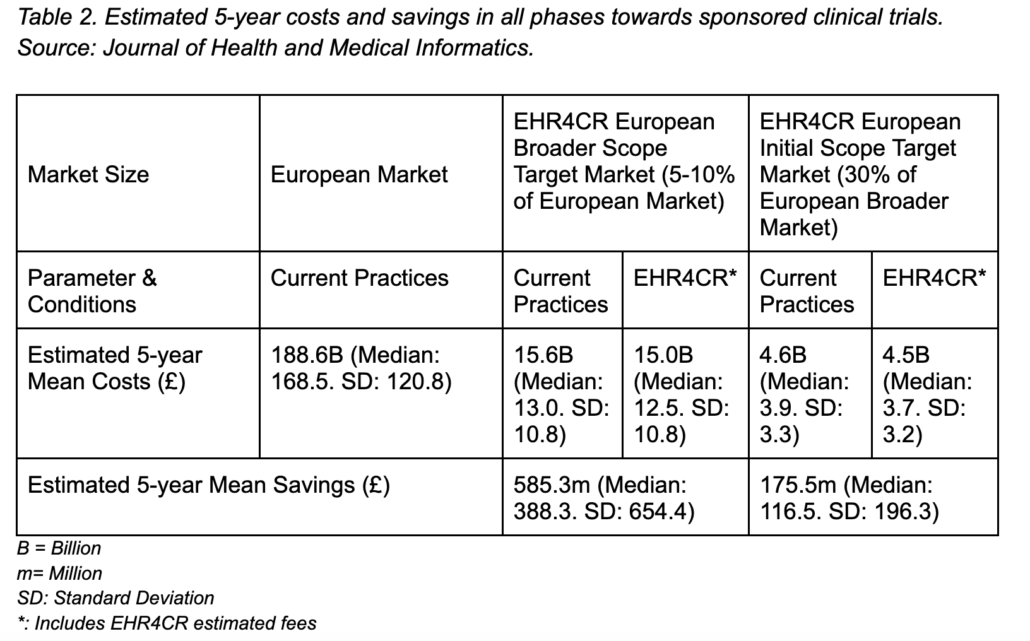

A research paper by Dupont and team5 further supports our notion that speeding up the recruitment process across all phases of trials in clinical research can save overall costs. By using technological means (“EHR4CR”) the research team did a financial assessment of how sponsored clinical trials in the European and other markets can save cost up to 585.3 million and 175.5 million Euro respectively based on an estimated 5-year mean analysis by speeding up overall recruitment processes. Below we provided a breakdown of the findings highlighted from their case research analyses conducted:

Another approach to overall cost-effectiveness that is emerging today is utilizing social media platforms. Issues such as duplicating records from Health records, such as the EHR4CR initiative, can still take time to detect. Clinical recruitment through digital marketing such as social media platforms like Instagram, Facebook, and Twitter is breaking through barriers, such as reaching out to hard-to-reach populations, simplifying the message and speeding up overall recruitment processes for clinicians and researchers.

This information and research conducted by Wisk and team6 further illustrate that Facebook was considered the most successful platform in retaining valid information and complete follow-ups at approximately 88% across all demographics. Comparisons and validity checks were obtained from Google Analytics and preliminary data on the platform user base. More importantly, there were no safety concerns, with participants known to report high acceptability for future recruitment. The mentioned research, in tandem with Clinials’ simplifying concept of breaking down technical, clinical jargon for our participants and utilizing Facebook as a primary clinical marketing platform, has shown viable success – our recent experiences with various clinical trials and assisting pharmaceutical companies/researchers/ clinicians (E.g., Vaccine trials) in speeding up recruitment processes. To find out more about Clinials success, you can see our case studies here.

At Clinials, we firmly believe that patent expiration is not the end of the product’s life. With proper yet strategic balancing, it can be a second beginning to serve our ever-diversifying healthcare needs on a global scale. In tandem, by speeding up the overall recruitment process, sponsors can not only meet rigid deadlines but stay ahead of them and will be able to bring new interventions to patients efficiently and quicker.

Extra information on EHR4CR:

The EHR4CR (Electronic Health Records for Clinical Research) European project consists of one of the most significant public-private research partnerships funded by the European Commission and by the European Federation of Pharmaceutical Industries and Associations (EFPIA) in the frame of the Innovative Medicines Initiative (IMI) joint actions (http://www.ehr4cr.eu/). This vast multidisciplinary research initiative has developed an innovative technological platform that enables the trustworthy reuse of health data contained in hospital-based EHR to enhance and speed up clinical research practices and recruitment.

Resources:

- https://www.maddocks.com.au/insights/full-court-finds-swiss-style-claims-invalid-hypothesis-as-prior-art-and-obviousness-of-invention

- The Hatch-Waxman act was passed in 1984 allowing patent extenders of 5 years to make up for how long the FDA approval process can take.

- Drugs that are not developed by the pharmaceutical industry for economic reasons but which respond to public health needs.

- Song CH, Han JW. Patent cliff and strategic switch: exploring strategic design possibilities in the pharmaceutical industry. SpringerPlus. 2016 Dec;5(1):1-4.

- Dupont D, Beresniak A, Schmidt A, Proeve J, Bolanos E, Ammour N, Sundgren M, Ericson M, Kalra D, De Moor G. Assessing the financial impact of reusing electronic health records data for clinical research: results from the EHR4CR European project. J Health Med Informat. 2016;7(3):235.

- Wisk LE, Nelson EB, Magane KM, Weitzman ER. Clinical Trial Recruitment and Retention of College Students with Type 1 Diabetes via Social Media: An Implementation Case Study. Journal of diabetes science and technology. 2019;13(3):445–56.